18

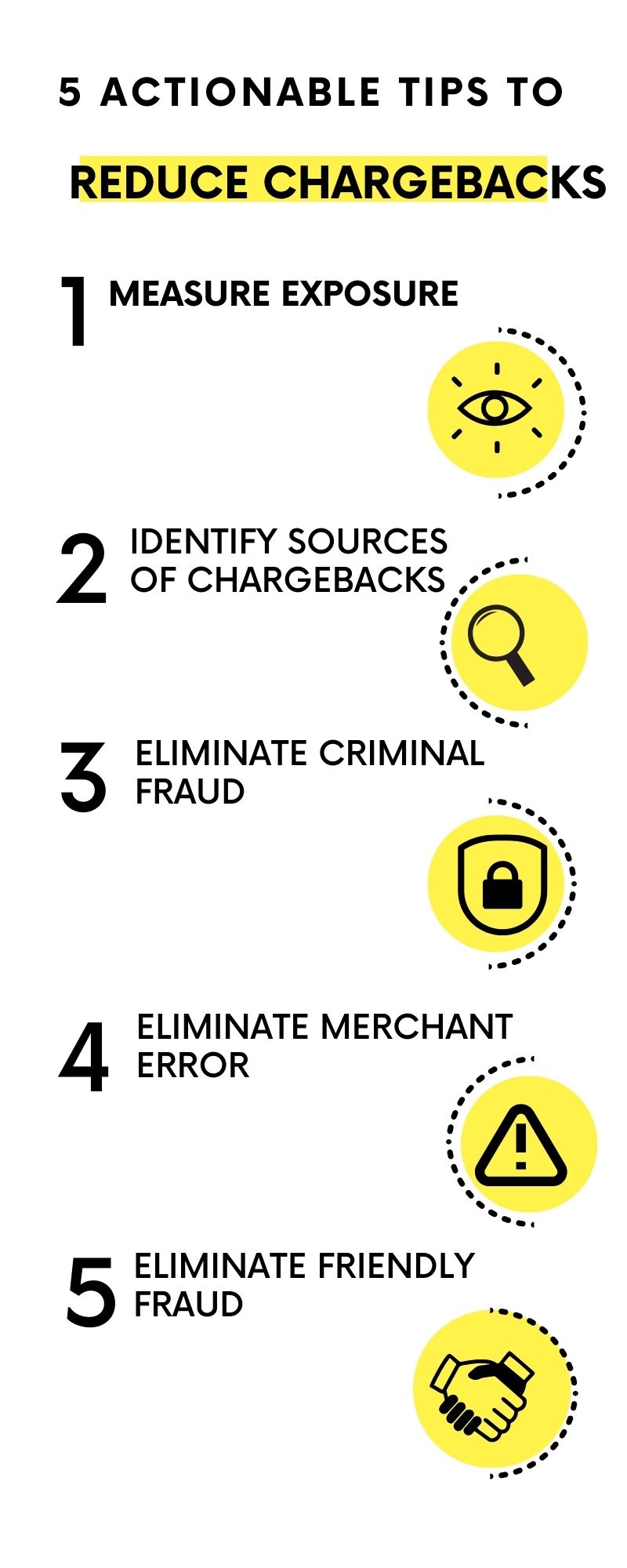

Jul 20235 Actionable tips to reduce chargebacks

Posted on July 18,2023 by abzerdxbadmin

1. Measuring Exposure

Frequent chargeback issuance might eat well into your hotel’s revenue, not to mention the costs incurred. The first step in reducing chargebacks is measuring how vulnerable your business is and how much is at stake.It is estimated that an average merchant suffers as many as 200-odd chargebacks. The revenue lost will be aggravated if you take into account the dispute resolution cost that can be at an average of 146$.This will amount to 30,000$ per month. As seen, direct chargeback losses can be huge.According to LexisNexis Report, for every dollar lost, an extra $2.36 is lost.Let’s have a look at the costs of every chargeback • A slew of charges to cover the chargeback resolution process • Interchange fees, chargeback money, shipping, any other miscellaneous fee incurred • Loss of money spent on the product and any future profit from it • Banks remove funds from hotel or merchant account • Challenging chargeback can be expensive • Too many chargebacks can lead to merchant account termination2. Identifying Possible sources of Chargebacks

What could possibly cause chargebacks?Assessing the source of chargebacks is very crucial for nipping it at the bud.It is imperative for an issuing bank to attach the reason code for a particular chargeback.It explains the logic behind the dispute. For instance, a consumer may claim that an amount was deducted without his authorization.But this code can be misleading because in spite of what the source code says, there are usually only three types of chargeback sources. Let’s see what each one is.Criminal Fraud

Criminal fraud occurs when a data breach is intentionally done by unethical hackers and cyber fraudsters.The cardholder’s sensitive card information is compromised and this leads to an unauthorized transaction.Merchant error

It is human to err, and a minor manual error from the merchant’s side can lead to a chargeback. Bad business practices, shoddy policies, or even a mild processing error can lead to chargebacks.Friendly Fraud

When a cardholder files for chargeback without a valid reason, it becomes a friendly fraud. It could be unintentional due to misunderstanding regarding the policies, or it could be a case where the cardholder is taking undue advantage.This category has earned a fancy sobriquet- cyber shoplifting!Sourcing disputes is absolutely necessary to counter chargebacks, but when a merchant is individually challenging a chargeback, it can be a herculean task. Also, the merchant is at a disadvantage as he is not equipped with adequate data.3. Eliminating Criminal Fraud

Criminal fraud must be parried at any cost as it can be a serious threat to the very existence of your business.Hence ruling out all possibilities of criminal fraud is imperative. Also, all chargebacks are in one way or the other interconnected.Most criminal frauds are avoidable and if it is left unchallenged, it can create a stack of unreliable data, which in turn will make it even more challenging to eliminate other chargebacks. Keeping criminal fraud under check can be easily achieved with the help of a multi-layer strategy in place.Fraud detection tools can ensure • Geolocation • Device fingerprinting • Velocity limits • AVS- Address verification Service • Fraud blacklists • CVV verification • 3D Secure technology4. Merchant Error

Merchant errors can be significantly reduced by • Ensuring accurate contact information on every page of the site • IVR phone systems should be removed and 24*7 customer support must be enabled via human contact • Be as responsive as possible to emails, and keep abreast of all social media handles • Strictly adhere to all rules and guidelines mentioned by card providers • Make sure that all policies are written in an easy-to-understand manner and are well read by consumers. • Be clear about cancellation policies and make refund processes swift and hassle-free. • Keep consumers fully informed about shipment of products and when they can expect delivery. • Be clear about product descriptions

5. Friendly Fraud

Fighting friendly fraud can be tricky because no merchant can ever know for sure whether the cardholder is deliberately cheating or not. It usually arises post a transaction. Ensuring that there are easy-to-understand billing descriptions can be a first step towards eliminating friendly fraud. It will help to make it clear if there is a change in services or fees. To dispute a friendly fraud, the best way is representment. Representment empowers merchants to dispute a chargeback that was filed unreasonably. You can recover the chargeback money and retrain consumer response to prevent chargeback scams in future.Let’s Conclude…Every merchant wishes to save time and recover revenue by eliminating chargeback. There is no one path to follow to avoid chargebacks. But having a chargeback management in place can ensure that chargebacks are eliminated to a great extent.The crux of the matter is that most merchants barely have the knowledge, time, or resources to keep chargebacks at bay.If chargeback limits are breached, the merchant risks losing his account. Visa and Mastercard have their own limits.Empowering your business with chargeback alerts will be a great way to get alerted about chargebacks before they become one.Recently Added Blogs